According to the Penom Institute, almost 2 million people were victims of medical identity theft in 2013. Medical identity theft is one of the fastest-growing types of identity theft in the United States. Although it’s often stolen by hackers and sold on the black market, a friend or family member in need of health insurance benefits could also commit medical identity theft. With so much at stake, it’s important to be conscious of identity theft and how to prevent it.

What Is It?

Most people are familiar with identity theft, but most people don’t also realize that there is a new form of identity theft prevalent in the United States. Medical identity theft is the practice of stealing a person’s health insurance or identity to receive health care, including emergency room visits, urgent care, or receiving prescription medication. Since medical bills can be so prohibitive, some thieves may steal health insurance benefits so they can have a procedure done. Other thieves may steal the information to sell on the black market.

Be on the Lookout

There are warning signs that your medical information may have been compromised. Receiving a bill for medical services that you did not request or have is a major warning sign that someone may have stolen your information. A call from a debt collector may also be a sign that your information may have fallen into the wrong hands. If you are proactive and check your credit report, there may also be unpaid medical bills listed under collections even if you were never contacted.

How to Prevent It

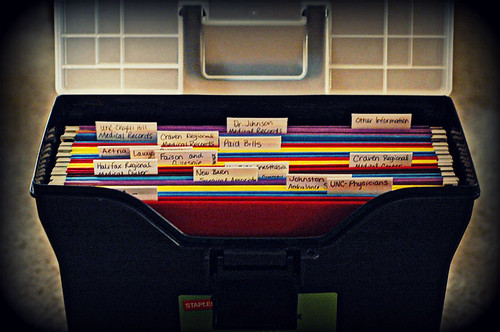

Medical identity theft can be a big headache, so it’s important to be proactive in preventing it. Be cautious with all aspects of your identity. Don’t share your insurance information over the phone or through email. Make sure you shred any medical documents or any documents that have you Social Security number before you throw them away. If a medical professional requests your Social Security number, ask if it is truly necessary; many times it is just a default question on paperwork. If you have a Health Savings Account, check that there aren’t any access charges to that account regularly. Finally, be sure to document any doctor visits you or your covered family member make and what the reason is.

Correcting Mistakes

Image via Flickr by BLW Photgraphy

Even the most careful people can fall victim to medical identity theft. To catch it early, request a copy of your accounting of disclosures from your insurance company, which is free every 12 months. If you find a mistake, make sure you contact the administrators of your health plan with proof that there is an error. Be sure to document all of your communication with anyone involved in the process, especially if they will be removing claims for your account. Furthermore, it’s important to file complaints with the state attorney general and the state insurance department to try and catch the person responsible for the theft.

Medical identity theft can be a scary thing, especially considering all that is at stake. However, you put yourself at much less risk if you are proactive, and act quickly if you have any suspicions that you could be a victim